Property tax assessments and challenges

If you own a home and property in Michigan, you must have received an assessment notice in the mail this month, starting this week.

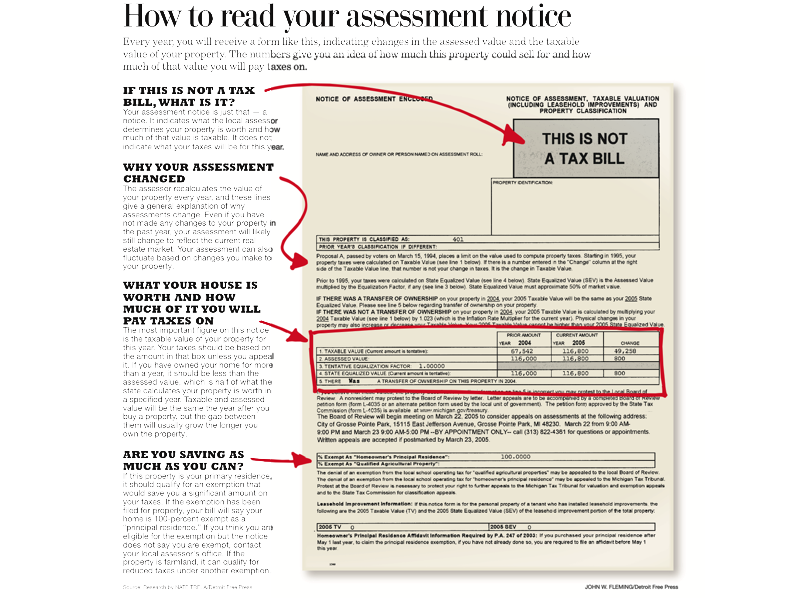

The assessment is not a tax bill. It shows changes to the taxable value and the state equalized value, which is the estimated market value of the property by the state.

If you have been living in your house for a few years, your increase should be between 1 and 5 percent. The taxable value-line reflects the change.

If you bought a new home or made improvements to your home last year, the changes could be greater than 5 percent, sometimes doubling your taxes.

To calculate the change, some cities include the dollar amount of the increase on the notice while others direct you to their website to figure it out, such as the city of dearborn. On the website, you enter the old and new numbers and it would give you the increase in dollars.

If the change is a lot more than you expect, you can appeal the assessment to the city or township where you live this month. Each municipality holds three days to appeal the increase, and they are stated on the notice. You must have solid evidence to challenge the increase. Or, you can hire professionals to challenge the increase.

In most cases, the city is going to turn you down. If it does and you feel you have a solid case, you can appeal to the state of Michigan Tax Tribunal online. The appeal is free and the tax tribunal will study your case and let you know via email if your case is accepted or not. Once the case is accepted, both you and the city are notified of a date to appear in front of an administrative judge in Lansing.

Don’t worry, you seldom have to go to Lansing because once the city finds out, assessors call you to make you and a reasonable offer. Click here for more information about the tax tribunal.

It is very important to challenge the tax increase because it adds up over the years. If you need help understanding your tax assessment, feel free to contact the city immediately.

On a separate note, this is the best time to sell your home for the most money. We have a list of buyers and they are looking for homes. Call 313-819-0101 for more information.