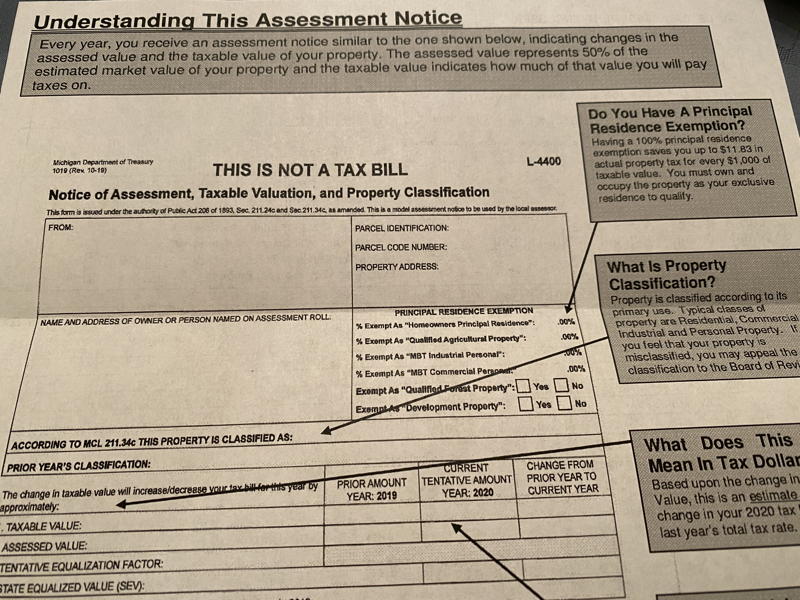

Understanding your property assessment notice

All homeowners should receive an assessment notice in the mail either this weekend or in a few days.

This is not a tax bill.

It rather shows changes in the assessment of your property, either an increase or a decrease. Either more or less in taxes.

It also shows the time and date that you could contest the changes at the city level. Every city is different.

If you need help understanding the notice, please call at 313-819-0101.

The property tax appeal process

Here are some tips on how to file your tax appeal.

1- Find out when the city is accepting appeals and schedule a meeting

2- Read your assessment letter and find out if it is accurate and it represents your property information.

3- Decided if a property tax appeal is worth your time and effort. If the property value is consistent with the market value of your neighborhood, it may not be feasible to lower your taxes.

4- Get the comparable values in the neighborhood. The city uses blocks to determine values. get the value of homes immediately around you without crossing into a major road. You find values on the city’s website at a small cost.

5- Present your case to the city. Make sure you have the correct information and convincing evidence.

6- If you hare not happy with the city’s decision, you can appeal to the Tax Tribunal. Click here to visit the Tax Tribunal site.

Here is additional information for lowering your taxes